PLANNING SPOTLIGHT

Buying a Home When Interest Rates are on the Rise

By Dylan Greene, CFP®,

Affinia Financial Planning, October 2022

Homeownership has been a cornerstone of building personal wealth for many generations of Americans. If you are currently thinking about buying (or selling) a home, it is good to know about the relationship of interest/mortgage rates and home prices to help you evaluate your choices.

The Housing Market

Prices are sky-high.

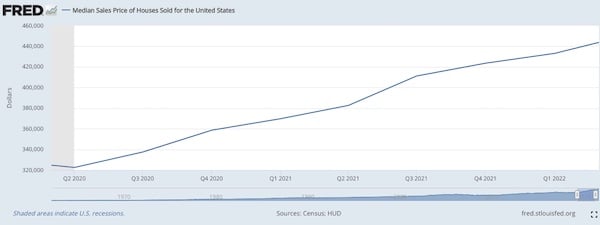

High buyer demand coupled with low housing supply has led housing prices to soar. The median sales price of homes in the U.S. jumped from $322,600 in March 2020 to $440,300 in March 2022; a whopping 36% increase in just two years.

The demand for housing has been fed by several factors, including:

- Historically low interest rates, which translate into historically low mortgage rates, made homeownership achievable for many. By December 2020, the 30-year mortgage rate plummeted to a new historical low of 2.68%. Rates spent most of 2021 between 2.70% and 3.10%, giving many borrowers an opportunity to refinance or buy homes at the lowest rates ever recorded. This picture has changed dramatically in 2022.

- Demographics contributed to the number of people entering the homeownership phase of life. Many millennials, the largest demographic group in the U.S., now ages 26- 41, are now becoming homeowners.

Last but not least, the pandemic-induced Work-From-Home (WFH) phenomenon led many to reevaluate their need for living space and lifestyle choices.

This imbalance has grown as buyers find it more and more difficult to find an affordable home, and sellers are discouraged from selling by the prospects of finding and affording a new home.

Source: https://fred.stlouisfed.org/series/MSPUS

Interest rates

On the rise- but how high will they go?

2022 has seen a directional change in interest rates, as inflation (think the cost of living) has escalated. There are many reasons for this, including supply chain and energy issues, the Russia/Ukraine war and monetary policy to name a few.

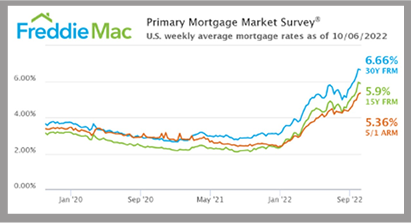

To tame inflation, the Federal Reserve has raised their benchmark Fed Funds rate 5 times thus far in 2022 from near zero to over 3%. These rate hikes have caused the average interest rate on a 30-year fixed rate mortgage to more than double, from 3.11% on 12/30/21 to 6.66% on 10/06/22. Source: https://www.freddiemac.com/pmms

What can you afford?

Calculate your Housing Affordability Index

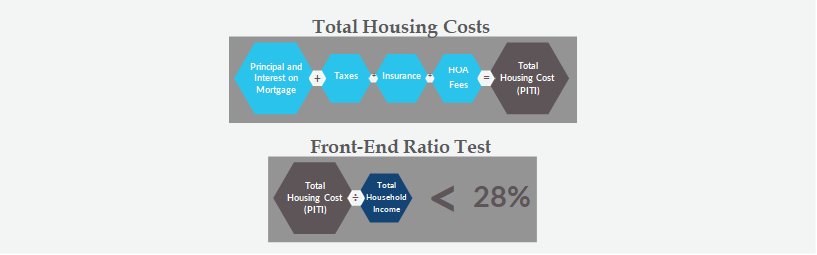

When applying for a mortgage, the first number to calculate is the Front-end Ratio. In general, the Front- end Ratio test states that total housing costs (Principal & Interest on a mortgage, Taxes, Insurance, and HOA fees) should not exceed 28% of a buyer’s total gross income.

Once you know your Front-end Ratio and the interest rate you are able to secure on your mortgage, you can get an idea of what you can afford to pay for a home. As you will see from the following example, the mortgage rate you are able to secure has a huge impact on the price you can afford to pay.

Example:

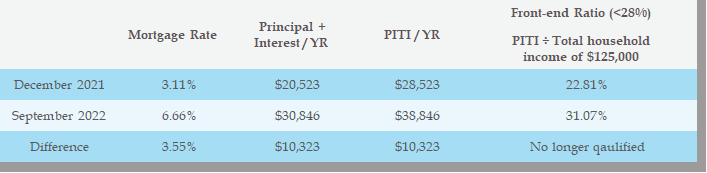

John and Judy are married and have just had their first child. They decided Judy would now work only part-time and together, their total annual income will be $125,000/year. They are interested in buying a home listed for $500,000 with combined property taxes and insurance of $8,000 per year. They plan to make a 20% down payment of $100,000 from their savings and finance the remaining $400,000 with a 30- year fixed rate mortgage.

Unfortunately, interest rates and thereby, mortgage rates, have been rising throughout 2022 from 3.11% in December 2021 rate to 6.66% in September 2022. Calculating their Front-end Ratio at each of these rates will illustrate the impact of rising rates on the viability of John and Judy’s home purchase.

PITI = Principal +Interest + Taxes+ Insurance

The above targets are estimates based on certain assumptions and analysis made by the advisor.

There is no guarantee that the estimates will be achieved.

1, Annual mortgage payments have increased more than 50% since December 2021.2. The additional cost of this rate increase over the 30 year life of the mortgage would be $309,697.

3. Due to the increase in rates, John and Judy no longer meet the Front-end Ratio test threshold of 28%. To move ahead with the purchase, they would need to increase their annual income or put down a larger down payment, thereby reducing their required mortgage payments.

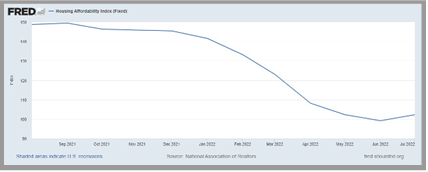

John and Judy are not alone; the Housing Affordability index, which measures the degree to which a typical family can afford the monthly mortgage payments on a typical home, has been steadily declining over the 2020-2022 time period.

John and Judy are not alone; the Housing Affordability index, which measures the degree to which a typical family can afford the monthly mortgage payments on a typical home, has been steadily declining over the 2020-2022 time period.

Rent vs. Buy

Does it make sense to rent?

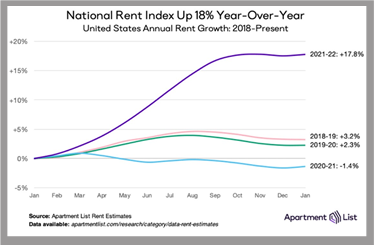

Housing is a basic human need and with individuals and families struggling to purchase affordable housing, demand has trickled down to the rental market. Increased demand has caused already rising rents to skyrocket, showing double digit increases

for most of this year. Perhaps this data is the most convincing evidence pointing to an imbalanced housing market.

Making a Decision

Weigh your options

https://dfdnews.com/2022/01/28/apartment-list-national-rent-report/

The data in the following months should reveal whether the rise in rates is effectively cooling demand in the housing market and if home prices will plateau and even fall. When it comes to buying a home in the near-term, here are some options and rationales to consider.

1. Wait it out.- Based on the escalation of both prices and interest rates and the current level of economic uncertainty, you may choose to wait for more clarity about both interest rates and the housing market.

- By waiting, you buy yourself time to bolster your cash savings and further research the market.

- High home valuations and the rapidly rising costs of mortgages should in theory reduce the demand for houses in the short term. This may cause a decrease in prices and a shift in the market back toward equilibrium.

2. Go ahead with the home purchase.

- There are many factors that may affect your decision to purchase a home. If you believe rates are likely to go higher, it may make sense to lock in a current relatively “low” mortgage rate. Locking in a rate also clearly defines the cash flow you will need to meet your mortgage obligations.

- Refinancing is an option to explore if rates go lower down the road. There are costs associated with refinancing a mortgage and those should be included in your refinancing analysis.