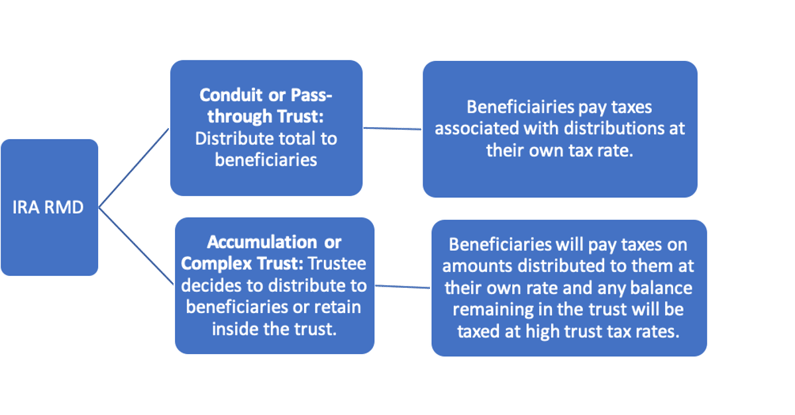

There are 2 types of trusts that are often set up as beneficiaries of a retirement account: (1) a conduit or pass-through trust and (2) an accumulation or complex trust. The diagram below depicts the treatment of distributions from the inherited IRA when a trust is the beneficiary.

Special Needs Trusts (SNTs) are accumulation or complex trusts. The trustee will have the authority to use the funds on behalf of the beneficiary over their lifetime. The RMD will be calculated using this “stretch” formula.

Even though the stretch provision still applies for beneficiaries with special needs, the elimination of the stretch provision for beneficiaries who do not have special needs may necessitate a change in planning strategy. In the past, many estate planners recommended that non-qualified assets be designated for funding a SNT upon a parent’s death. Individuals who have pursued this strategy may want to revisit both their own and their beneficiaries’ situations to determine if this still makes sense given the eligibility of the family member with a disability for the “stretch’ provision of an inherited IRA.

New Strategy: The SNT, with the family member with a disability as an exception beneficiary of the SNT, will inherit the IRA and become the owner.

In addition to the inherited IRA, the SNT will also own a non-retirement account for the purposes of receiving distributions (annual RMDs) from the inherited IRA and will pay taxes on this distribution. The trustee may utilize this money to pay for expenses for the individual while also protecting their eligibility for government benefits.

Upon the death of the beneficiary with special needs, proceeds of the IRA will flow to the contingent beneficiary and the 10-year rule will go into effect.

Stay tuned for Part 2 next week with further discussion of planning considerations and strategies in light of the SECURE Act.

* The Setting Every Community Up for Retirement Enhancement or SECURE act was signed into law on December 20, 2019, becoming effective January 1, 2020. The law provides important changes for individuals and small businesses to consider in their retirement, estate and tax planning.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Financial planning and investment advice offered through Affinia Financial Group, LLC, a registered investment advisor. Securities offered through LPL Financial, Member FINRA/SIPC. Affinia Financial Group and LPL Financial are separate entities.